The Ultimate Guid to Small Business Finance and Accounting

Build with Retainr

Sell your products and services, manage clients, orders, payments, automate your client onboarding and management with your own branded web application.

Get Started1. What is the main purpose of "The Ultimate Guide to Small Business Finance and Accounting"?

The Main Purpose of "The Ultimate Guide to Small Business Finance and Accounting"

The main purpose of "The Ultimate Guide to Small Business Finance and Accounting" is to provide vital information and helpful resources to small business owners to help them navigate the complex sphere of finance and accounting. The guide serves three fundamental purposes to give a firm understanding and practical knowledge to small businesses on effective finance and accounting techniques:

- Provides an explanation and understanding of financial and accounting terms

- Guidance on financial planning and budgeting for small businesses

- Teach the basics of taxation and compliance for small businesses

Breakdown of the Guide's Purpose

To provide further clarity, the guide's purposes can be breakdown as such:

| Purpose | Description |

| Understanding of Financial and Accounting Terms | This means breaking down complex financial jargon for business owners so that they can understand concepts such as balance sheets, revenue, assets, liabilities etc. |

| Guidance on Financial Planning and Budgeting | Providing strategies for monetary planning, budget allocation, forecasting, and tracking income and expenditures to optimize profits and ensure financial stability. |

| Basics of Taxation and Compliance | Teaching the fundamentals of taxation, including understanding which taxes apply to their business, how to comply with tax laws, and tips to manage their tax burden effectively. |

Beneficiaries of "The Ultimate Guide to Small Business Finance and Accounting"

In essence, "The Ultimate Guide to Small Business Finance and Accounting" is a helpful companion for anyone involved in managing the finances of a small business. This includes but is not limited to business owners, CFOs of small businesses, financial managers, and budding entrepreneurs. The guide acts as comprehensive handbook offering crucial insights in understanding and managing the financial aspect of a business effectively and efficiently.

2. Who is the target audience for "The Ultimate Guide to Small Business Finance and Accounting"?

Defining the Target Audience

The Ultimate Guide to Small Business Finance and Accounting is primarily designed for business owners who are at the early stages of their venture. This includes entrepreneurs, startup founders, and new business owners who need a comprehensive understanding of the financial management elements of their business. It is also suitable for anyone interested in starting a small business and wishes to get a head start in understanding the financial and accounting aspects.

Key Audience Subgroups

- Entrepreneurs: Those planning to start a business and need to understand the financial challenges they might face.

- Start-up Founders: Individuals that have already set up a business and are searching for additional financial and accounting knowledge to ensure their business's success.

- New Business Owners: People who have recently started a new business and have to navigate financial and accounting aspects of their enterprise.

- Aspiring Business Owners: Individuals planning to start a business and seeking a comprehensive understanding of small business finances and accounting.

Scope of the Guide

| Audience | Benefits |

|---|---|

| Entrepreneurs | Understanding financial challenges, planning finances |

| Start-up Founders | Advanced financial knowledge, making informed decisions |

| New Business Owners | Handling finances, understanding integral accounting aspects |

| Aspiring Business Owners | Familiarity with small business finances, preparing for potential challenges |

3. How can "The Ultimate Guide to Small Business Finance and Accounting" help a startup?

Understanding Basic Business Finance and Accounting

The Ultimate Guide to Small Business Finance and Accounting can be an invaluable tool for startups. It provides necessary insights into finance fundamentals such as cash flow management, financing options, and profitability measures. The guide also delves into specific accounting principles startups need to know including balance sheets, income statements, and the importance of maintaining accurate financial records.

- Cash flow management: Understanding how cash moves in and out of the business.

- Financing options: Details about debt financing, equity financing, and grants.

- Profitability measures: Metrics like gross profit margin, net profit margin, and return on investment.

- Balance sheets: Definition, components, and how to read them.

- Income statements: Explanation, structure, and analysis.

- Maintaining financial records: Importance, methods, and practices.

Strategic Decision Making and Planning

Moreover, by equipping the startups to comprehend their company's financial health with the help of this guide, they can make strategic decisions. These decisions might include whether to invest in new products, determine pricing strategies, or divest from non-performing assets. The guide allows for better forecasting as well, with comprehensive sections on sales forecasting, budgeting, and financial projections.

| Area | Description |

|---|---|

| Investment decisions | Determining areas for potential growth or expansion |

| Pricing strategies | Performing cost-volume-profit analysis |

| Sales forecasting | Predicting future sales based on patterns and trends |

| Budgeting | Allocating resources effectively to maximize profits |

| Financial projections | Estimating future revenues, costs, and profits |

Navigating Regulatory Compliance

The guide possesses in-depth sections on regulatory compliance - a possible minefield for startups. Understanding tax obligations, accounting regulations, and mandatory financial reporting can help startups avoid costly penalties and potential legal issues. The guide may also provide useful tips on how to choose an accountant or bookkeeper, when to seek legal advice, and how to ensure compliance with financial regulations.

- Tax obligations: Types of taxes, applicable tax breaks, and filing procedures.

- Accounting regulations: Details on Generally Accepted Accounting Principles (GAAP), the role of the Financial Accounting Standards Board (FASB), and other relevant topics.

- Mandatory financial reporting: Requirements for the balance sheet, income statement, and other financial disclosures.

- Choosing an accountant or bookkeeper: Selection criteria and questions to ask potential candidates.

- Seeking legal advice: Potential red flags and when to consult a professional.

4. Where can I buy "The Ultimate Guide to Small Business Finance and Accounting"?

Online Stores

There are several online platforms where you can easily purchase "The Ultimate Guide to Small Business Finance and Accounting". Some of these platforms include:

All these platforms provide safe and secure transactions and can ship the book to your location.Physical Bookstores

"The Ultimate Guide to Small Business Finance and Accounting" can also be purchased from various physical bookstores. Below is a table showing some popular bookstores where the guide may be available:

| Bookstore | Location |

|---|---|

| Barnes & Noble | Various Locations across the United States |

| Books-A-Million | Various Locations primarily in the Eastern United States |

Digital Editions

If you prefer digital versions, "The Ultimate Guide to Small Business Finance and Accounting" is available in e-book format and can be bought from:

Digital editions offer the convenience of portability and accessibility from any device.5. What are some key topics covered in "The Ultimate Guide to Small Business Finance and Accounting"?

Key Topics in Small Business Finance and Accounting

"The Ultimate Guide to Small Business Finance and Accounting" covers a wide range of crucial topics. These include:

- Understanding Basic Accounting Concepts: This covers the fundamental principles that all business owners need to know, such as the difference between debits and credits, assets and liabilities, and profit and loss statements.

- Setting Up Your Business’s Accounting System: This provides step-by-step guidelines on how to set up your own accounting system, including tips on which software to use, how to categorize your expenses, and how to track your income and expenses accurately.

- Financial Statements Analysis: It explains how to read, understand, and analyze key financial statements, including balance sheets, income statements, and cash flow statements.

- Tax Planning and Compliance: This topic offers an overview of the tax obligations of small business owners and provides strategies for tax planning and compliance.

- Cash Flow Management: This section instructs businesses on how to manage their cash flow, one of the key success factors of any business.

Further Depth

In addition to these key subject areas, "The Ultimate Guide to Small Business Finance and Accounting" also delves into the nitty-gritty aspects of finance and accounting that could make or break your small business. Topics such as financial ratio analysis, forecasting, budgeting, and pricing strategies are discussed in detail.

Key Takeaways

| Topic | Key Takeaway |

|---|---|

| Basic Accounting Concepts | Understand and distinguish between key accounting terms |

| Setting Up Your Business’s Accounting System | Learn how to set up and manage an effective accounting system |

| Financial Statements Analysis | Learn how to read and analyze financial statements for business decision making. |

| Tax Planning and Compliance | Understand your tax obligations and learn strategies to fulfill them effectively. |

| Cash Flow Management | Equip yourself with the skills to manage your cash flow effectively to maintain business sustainability. |

6. Is "The Ultimate Guide to Small Business Finance and Accounting" suitable for someone with no financial background?

Is this guide suitable for beginners?

The "Ultimate Guide to Small Business Finance and Accounting" is a comprehensive guide that is created with simplicity in mind. It covers a wide range of topics, which makes it suitable not only for people with a financial background but also for those who are completely new to finance and accounting. The guide assumes the reader has no prior knowledge, which is beneficial because:

- The simple and easily understandable language is user-friendly for beginners.

- It explains terminologies in a comprehensive manner.

- Examples are included to elucidate the concepts.

Content of the Guide

In this guide, you will learn about the following topics:

| Sections | What You Will Learn |

|---|---|

| Accounting Basics | Understand the basics of bookkeeping, recording transactions, and interpreting financial statements including profit and loss, balance sheet and cash flow statement. |

| Financial Management | Understand budgeting, forecasting, managing cash flows, and other financial management techniques that are essential for the sustainability and growth of small business enterprises. |

| Advanced topics | Dive deep into advanced topics like tax planning, auditing, risk management, and ethical considerations in finance. |

Other Resources Provided

Furthermore, the guide includes several additional resources that aid in learning and understanding. These are:

- Case studies: Real life examples that demonstrate the application of theories and principles.

- Interactive quizzes: Test your understanding and reinforce learning.

- Tips from experts: Industry veterans provide tips and share their experiences.

7. How detailed is the information provided in "The Ultimate Guide to Small Business Finance and Accounting"?

Detail Level of Information Provided

"The Ultimate Guide to Small Business Finance and Accounting" is a comprehensive handbook that provides a deep dive into the financial aspects of a business. The guide covers a spectrum of information, from basics to advanced concepts, which is neatly organised and explained in detail. The information is extensive, precise, and presented in a way that is easily digestible for readers of various levels of expertise.

List of Topics Covered

- Finance vs Accounting: Explains the differences between two heavily interconnected fields, both crucial for the operation of a successful business.

- Understanding Financial Statements: An in-depth review of income statements, balance sheets, and cash flow statements.

- Accounting Principles: Review of different accounting principles like accrual-based and cash-based accounting.

- Taxes and Compliance: An elaborative explanation about various tax laws and rules for small businesses.

- Financial Management: Covers strategic planning, performance monitoring, and effective decision-making.

Each chapter dives deep into the subject matter, providing a comprehensive understanding of these topics. The guide also includes case studies, practical examples, and actionable tips to apply the knowledge effectively.

Information Specificity

| Topic | Specificity Level |

|---|---|

| Finance vs Accounting | High |

| Understanding Financial Statements | High |

| Accounting Principles | High |

| Taxes and Compliance | Intermediate |

| Financial Management | High |

As shown in the table, the guide is highly specific about all topics, except 'Taxes and Compliance', where the complexity of the topic necessitates the readers to seek external professional help for detail understanding. Overall, "The Ultimate Guide to Small Business Finance and Accounting" is a valuable resource for any small business owner or student aspiring to learn about this crucial aspect of business operation.

8. Can "The Ultimate Guide to Small Business Finance and Accounting" help me better understand and manage my business’s financial health?

Understanding and Managing Business's Financial Health

Yes, "The Ultimate Guide to Small Business Finance and Accounting" can greatly assist you in understanding and managing the financial health of your business. It provides valuable insight to comprehend financial terminology, optimizing tax payments and smooth handling of accounting operations. The guide believes comprehensive financial knowledge empowers an entrepreneur to make informed strategic decisions. Below are some of the ways this comprehensive guide can be beneficial:

- Financial Statements: The guide provides detailed explanations and examples of profit and loss statements, balance sheets, and cash flow statements. Understanding these documents is crucial to assess your company's overall financial standing.

- Budgeting and Forecasting: Learn how to prepare accurate budgets and financial forecasts to plan your business growth effectively. The guide illustrates the importance of these tools in allocating resources and anticipating future expenses and income.

- Taxation: The guide also offers information on different tax laws applicable to small businesses. By optimizing tax payments, your business can maximize its profit margin.

Key Financial Ratios in the Guide

In addition to the above topics, "The Ultimate Guide to Small Business Finance and Accounting" also educates on various key financial ratios. These ratios play a pivotal role in evaluating the health of a business and making productive financial decisions. Some of the ratios discussed in the guide includes:

| Name of Ratio | Purpose |

| Debt to Equity Ratio | Measure financial risk and leverage |

| Gross Margin Ratio | Understand profitability considering cost of goods sold |

| Return on Assets | Efficiency of a business in using its assets to generate profit |

To sum it up, "The Ultimate Guide to Small Business Finance and Accounting" is an indispensable resource that helps you to not only understand but manage your business's finance effectively. It is structured to ease the comprehension of complex financial concepts and their practical implementation in your business.

9. Are there real-world examples included in "The Ultimate Guide to Small Business Finance and Accounting"?

Real-World Examples in The Ultimate Guide to Small Business Finance and Accounting

The "Ultimate Guide to Small Business Finance and Accounting" understands that theory is never enough, always setting the information within the tangible frame of real-world examples. These examples are carefully selected and in-depth, helping you understand key principles in a practical context. Following are just a few of the examples you'll find.

- Example 1: "John's Bakery" - This is an in-depth case study on the financial journey of a local bakery business, giving readers a clear understanding of cash flow management, inventory accounting, and capital finance.

- Example 2: "Tech Innovators Inc." - This example takes a look at a tech startup company’s finances, focusing on areas such as fundraising, allocating resources effectively, and understanding complex phases like seed, early, and growth stage financing.

- Example 3: "Greentree Landscaping" - A scenario showcasing a small service-based business, highlighting vital areas such as fixed versus variable costs and break-even analysis.

Below is a table that summarises the key accounting and finance topics covered in these real-world examples.

| Business Example | Key Topics |

|---|---|

| John's Bakery | Cash flow management, Inventory account, Capital finance |

| Tech Innovators Inc. | Fundraising, Resource allocation, Understanding finance stages |

| Greentree Landscaping | Fixed vs variable costs, Break-even analysis |

10. What kind of practical tips and resources does "The Ultimate Guide to Small Business Finance and Accounting" offer to small business owners?

Practical Tips Offered by The Ultimate Guide

The Ultimate Guide to Small Business Finance and Accounting provides various practical tips that help to enhance proper management of financial resources. Firstly, the guide advises on efficient bookkeeping. By keeping track of all transactions and updating financial records regularly, business owners can have real-time oversight on their financial progress. Secondly, the guide emphasizes the importance of monitoring the cash flow. It can help to anticipate potential financial pitfalls and adjust tactics in time. Thirdly, the guide suggests setting aside a fraction of profits to cater for taxes, thus avoiding end-of-year financial shocks.

Resources Offered by The Ultimate Guide

The Ultimate Guide provides several valuable resources that facilitate effective finance and accounting operations in small businesses. These include:

- Links to professional accounting software such as Quickbooks and Xero.

- References to online financial management courses like Coursera and Udemy.

- Resources for tax planning and preparation, such as IRS small business tax guide.

- References to websites and blogs where small business owners can access financial advice, for instance, the Small Business Administration’s Learning Center.

What The Resource Table Looks Like

To further simplify the procedure of accessing these resources, The Ultimate Guide also provides a neatly organized table as follows:

| Resource Type | Resource | Link |

|---|---|---|

| Accounting Software | Quickbooks | Website |

| Financial Management Courses | Coursera, Udemy | Website, Website |

| Tax Planning | IRS Small Business Tax Guide | Website |

Conclusion

Mastering Small Business Finance and Accounting

The complexities of dealing with small business finance and accounting can be overwhelming. Staying on top of assets, liabilities, income streams, and countless other financial matters is a daunting task. But worry no more, Retainr.io is here to make all this fairly easy for you.

Retainr.io: Your Ultimate Tool for Finance and Accounting

Designed with small businesses in mind, Retainr.io is your white-label software that effortlessly helps you manage Sales, Client relationships, Orders, and Payments. With your own branded app, your financial operations can be streamlined and automated, handling every facet of your financial transactions. Freed from the complexities of accounting, you can focus on growing and nurturing your business.

Sales and Client Relationship Management

Retainr.io is not just about financial management – it is also about improving your sales and customer relationships. Its robust client engagement tools will help you to drive business growth and will empower you to offer an enhanced client experience.

Order and Payment Management

Managing orders and payments can be a tiresome process. With Retainr.io, all your orders and payments can be tracked and processed in real-time. The built-in financial tools enable you to keep an eye on every transaction, ensuring nothing falls through the cracks.

Conclusion

In the world of small business, financial management can make or break your endeavor. A tool like Retainr.io simplifies the process, leaving you with peace of mind and time to watch your business thrive.

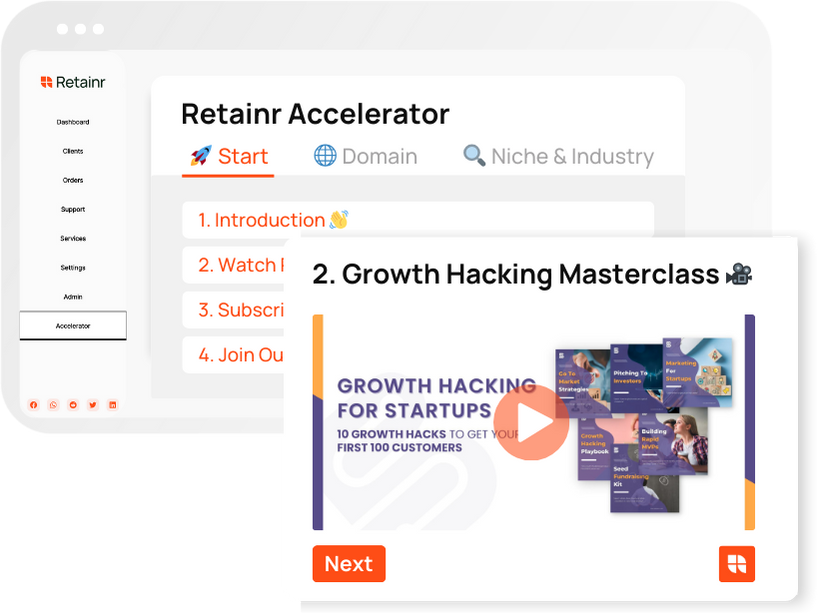

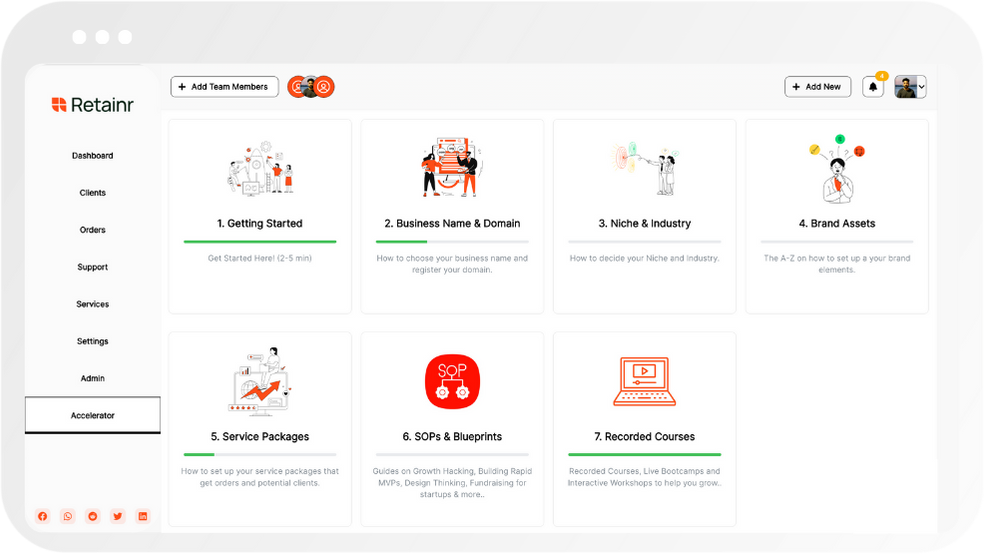

Boost Your Agency Growth

with Retainr Accelerator

Uncover secrets, strategies, and exclusive blueprints to take your agency's growth to the next level — from marketing insights to effective presentations and leveraging technology.

SOPs, Cheatsheets & Blueprints

Leverage 50+ SOPs (valued over $10K) offering practical guides, scripts, tools, hacks, templates, and cheat sheets to fast-track your startup's growth.

Connect with fellow entrepreneurs, share experiences, and get expert insights within our exclusive Facebook community.

.jpg)

Join a thriving community of growth hackers. Network, collaborate, and learn from like-minded entrepreneurs on a lifelong journey to success.

Gain expertise with recorded Courses, Live Bootcamps and interactive Workshops on topics like growth hacking, copywriting, no-code funnel building, performance marketing and more, taught by seasoned coaches & industry experts.

.jpg)

.jpeg)