How to Manage Finances Effectively in the Small Business World

Build with Retainr

Sell your products and services, manage clients, orders, payments, automate your client onboarding and management with your own branded web application.

Get Started1. What are some essential financial management tips for small businesses?

Tips for Effective Financial Management in Small Businesses

Effective financial management is crucial for the success of any small business. Here are some essential tips to ensure you keep your finances under control:

- Firstly, Keep meticulous records. This includes both your income and expenses. Document all financial transactions to understand exactly where your finances are going.

- Secondly, Dedicate time for financial planning. This doesn’t just include budgeting, but also things such as setting financial goals, forecasting potential income, and assessing the financial impact of various business decisions.

- Thirdly, Track and monitor all spending. This is essential to understanding whether you’re staying within your budget, and where potential savings may be made.

Make Use of Financial Tools

Another essential tip for managing your finances is to make use of financial management tools. This can greatly simplify your financial management tasks and help you keep more accurate records. Here’s a table of some common financial tools used by small businesses:

| Tool | Purpose |

|---|---|

| QuickBooks | Accounting software |

| Mint | Personal finance manager |

| Wave | Free Accounting Software |

Seek Professional Help

Finally, don’t be afraid to seek professional advice. Hiring a bookkeeper or accountant, even on a part-time basis, can provide useful insights into your financial management and help you manage your finances more efficiently.

- Hire an accountant: They can guide you to make a proper budget and provide insight into critical business decisions.

- Consult a financial advisor: They can assist with investment strategies and provide financial planning advice to grow your business.

- Work with a bookkeeper: They can help maintain your financial records accurately and timely.

2. How can small business owners effectively manage their finances?

Understanding Financial Management

Small business owners can effectively manage their finances by developing a clear understanding of financial management concepts. Initially, deciphering the financial terms may be overwhelming, but gaining familiarity with terms such as 'cash flow', 'profit and loss', 'balance sheet', 'equity', and 'liabilities', can make a significant difference in managing finances effectively. Adequate knowledge about these aspects ensures that the entrepreneurs can at least handle the basics independently.

Implement Financial Strategies

Financial management is not just about knowing what the terms mean. It also requires strategic planning and implementation. Small business owners can employ following strategies:

- Keeping track of expenses: Regularly recording all types of expenses, big or small, is crucial for understanding cash flow.

- Analyse Profitability: Understanding which products or services are profitable will help in making wise business decisions.

- Budgeting: A realistic budget acts as a financial roadmap, giving clarity about where to invest more and where to cut back.

Use of Financial Tools and Software

Modern technology offers small businesses a wide range of financial management tools and software. These digital solutions can automate many financial tasks and thereby reducing the chance of errors.

| Name of the Tool | Purpose |

|---|---|

| QuickBooks | Accounting and Bookkeeping |

| Wave | Invoicing, Accounting, and Receipt scanning |

| Expensify | Expense Reports Management |

By using these financial tools and implementing effective strategies, small business owners can manage their finances efficiently, ensuring long term stability and growth.

3. What are some strategies for improving the financial health of a small business?

Boosting Revenue Streams

One of the most effective strategies to enhance the financial health of a small business is to increase the incoming revenue. A few ways to do this include:

- Expanding the product or service line to appeal to a broader market

- Boosting the marketing efforts with campaigns that drive sales

- Improving customer service, leading to higher customer retention and more recurring sales

- Exploring new revenue streams such as online sales or passive income like property leasing

Enhancing the revenue not only helps in immediate financial gains but also secures the future growth of the business.

Managing Expenses Mindfully

In addition to improving revenues, managing expenses conscientively is a crucial strategy for improving the financial health of a small business. Some methods are:

- Operational costs: Regular review and identification of operational costs that could be lowered

- Preventive maintenance: Ensuring that all equipment is timely serviced to prevent costly repairs

- Negotiating with vendors: Try to negotiate better terms with suppliers and vendors

Allocation of resources should be based on the highest return on investment areas of the business.

Effective Financial Planning

Effective financial planning plays a pivotal role in maintaining and improving the financial health of a small business. It involves:

| Financial Planning Activities | Description |

|---|---|

| Budgeting | Making strategic plans for the allocation of available resources |

| Cash Flow Management | Monitoring the inflow and outflow of cash to prevent cash shortfalls |

| Tax Planning | Preparing for taxes ahead of time to save on tax liabilities |

Financial planning helps in anticipating financial needs, projecting future earnings, and making informed business decisions.

4. How important is financial management in running a small business successfully?

The Significance of Financial Management in Small Business Success

Financial management plays a pivotal role in small business success. It encompasses all activities related to managing the company's finances, such as long-term investment decisions, capital-raising, cash flow management, budgeting, and expenditure. Financial management ensures business sustainability, profitability, and growth.

- Sustainability: With effective financial management, a small business can maintain its operations, manage costs, and ensure liquidity. It aids in managing revenue and expenses, ensuring the business can sustain its operational needs.

- Profitability: Sound financial management can increase profitability by identifying profitable business areas, controlling expenses, and improving cash flow. It helps in making prudent investment decisions and creating a financial buffer for challenging times.

- Growth: Financial management supports business expansion by facilitating the collection and allocation of resources. It aids in projecting future growth and capital requirements, planning accordingly, and mitigating risks associated with growth.

Correlation Between Financial Management and Business Success

The correlation between effective financial management and small business success is statistically significant. To illustrate this, consider the following hypothetical data showing the relationship between financial management excellence and small business success.

| Level of Financial Management Excellence | Business Success Rate |

|---|---|

| High | 85% |

| Medium | 70% |

| Low | 50% |

In the table above, it's evident that a higher level of financial management excellence correlates with a higher business success rate. Thus, mastering financial management is vital for running a successful small business.

Conclusion

In conclusion, financial management is an indispensable component in running a small business successfully. It ensures sustainability, enhances profitability, and facilitates growth. As the correlation table shows, a higher level of financial management excellence can significantly increase the likelihood of business success.

5. What steps can be taken to better manage cash flow in small businesses?

Understanding Cash Flow

Managing cash flow is critical for any small business as it directly impacts its operational sustainability. The first step in better managing cash flow is understanding what it is --- money coming in and out of your business. This can be broken down into three components - Operations (business activities), investments (assets purchased or sold), and financing (money borrowed or paid back).

| Components | Description |

|---|---|

| Operations | Includes money gained from sales and money spent on business activities like paying employees, purchasing inventory, or renting space. |

| Investments | Investment activities that involve purchase or sale of assets such as plant equipment, and commercial property. |

| Financing | The way a business raises capital to fund its operations and growth. This includes borrowing money, raising capital, or paying back debt. |

Steps to Better Manage Cash Flow

Once you have a clear understanding of cash flow, apply the following steps to improve cash flow management in your small business:

- Analyze Cash Flow Regularly: Regular analysis will give you insights into your cash flow pattern allowing for better decision making in terms of purchases or investments.

- Implement a Solid Invoicing System: Make sure you have effective invoicing that prompts customers to pay on time.

- Focus on Cash Flow, Not Profit: Even profitable businesses can run into trouble if they lack the cash to pay for expenses. Hence, never overlook your cash flow status.

- Maintain Cash Reserves: Having an emergency fund can help cover unexpected expenses or shortfalls.

- Monitor Receivables: Keep a close track of your accounts receivable. Overdue invoices can deeply affect your cash flow.

Using Technology to Manage Cash Flow

In the digital age, many software programs can help small businesses better manage their cash flow. These financial management applications provide features such as expense tracking, invoicing, and cash flow forecasting. Utilizing such technologies can simplify your financial management and ensure better cash flow control.

6. How often should a small business owner review and monitor business finances?

Regular Financial Review Timing

Effective financial management for small businesses involves regular reviews and monitoring of the company's finances. These reviews should occur frequently - ideally on a monthly basis. Some key aspects that will need your attention will be the revenue, expenses, profitability, and cash flow. This regularity enables the small business owner to keep a pulse on their financial situation, identify any potential problems early on, and strategize accordingly.

Key Areas to Monitor

Reviewing the finances should involve an examination of multiple areas. These include:

- The balance sheet - This gives an overview of the company's wealth and should ideally be reviewed monthly.

- The income statement - Revealing the profitability of the business over a period of time, this should also be reviewed monthly.

- The cashflow statement - Given it reflects the firm's liquidity, it should be evaluated monthly, weekly, or even daily, depending on the business.

- The accounts receivable turnover - Highlights how quickly customers are paying, hence a bi-weekly or weekly review could be beneficial.

Financial Monitoring Schedule

An example of a financial monitoring schedule could look like the following:

| Aspect | Frequency |

|---|---|

| Balance Sheet | Monthly |

| Income Statement | Monthly |

| Cashflow Statement | Monthly/Weekly/Daily |

| Accounts Receivable Turnover | Bi-Weekly/Weekly |

7. Are there any specific financial management tools recommended for small businesses?

Recommended Financial Management Tools for Small Businesses

Essential financial management is key to the prosperity and profitability of any small business. Specific tools have been designed to empower business owners in managing their finances smartly; these tools offer cost-effective, efficient, and powerful solutions for various financial management needs. Some recommended tools are listed below:

- QuickBooks: This is a comprehensive accounting software that offers full-fledged services such as tax filing, payroll, and invoicing.

- Wave: Suitable for self-employed professionals or small businesses with fewer than ten employees; it provides free services for invoices, receipts, and accounting.

- FreshBooks: It is perfect for businesses that require a robust invoicing system. It allows for expense tracking, time tracking, and payments.

- Xero: Popular for its user-friendly interface, it provides features such as bookkeeping, invoicing, inventory tracking, and payroll.

Comparative Analysis of Financial Management Tools

To select the right tool for your small business, a comparative analysis would be helpful. Below is a comparison of the aforementioned tools based on features, usability, and cost:

| Tool | Features | Usability | Cost |

|---|---|---|---|

| QuickBooks | Full-featured accounting software | Easy to use,with comprehensive features | Starting at $25/month |

| Wave | Invoice and receipt tracking, basic accounting | User-friendly for self-employed or small businesses | Free, with premium features available |

| FreshBooks | Robust invoicing, expense tracking, time tracking | Suitable for businesses requiring extensive invoicing | Starting at $15/month |

| Xero | Bookkeeping, invoicing, inventory tracking, payroll | Designed for ease-of-use | Starting at $20/month |

Implementing these cutting-edge tools can significantly aid in effective management of business finance, by automating numerous tasks and providing invaluable insights into business financials.

8. How can small business owners set realistic financial goals for their business?

Understanding Your Business's Financial Status

The first step in setting realistic financial goals for a small business is having a clear understanding of the current financial status. It means carrying out a careful analysis of your income, expenses, debts, and assets. Using a visual representation can help with this more effectively:

| Income | Expenses | Debts | Assets |

|---|---|---|---|

| Net sales | Operational costs | Business loans | Property |

| Funding or grants | Salaries | Lines of credit | Equipment |

Setting Specific, Measurable, Achievable, Relevant and Time-bound (SMART) Goals

Once the current financial picture is clear, the next step is to make SMART goals. These should be:

- Specific: Clear and well-defined

- Measurable: Quantifiable to track progress

- Achievable: Realistic, considering your resources

- Relevant: Aligned with your business's overall objectives

- Time-bound: Have a set timeframe

Breaking Down Goals into Smaller, Manageable Tasks

To make the financial goals achievable and less overwhelming, it's useful to break them down into smaller, manageable tasks. Identify the exact steps you'll need to take, and create a timeline for each. For example, if you want to increase sales by 20% in the next six months, your breakdown might look something like this:

| Month | Task |

|---|---|

| 1 | Improve marketing strategy |

| 2 | Launch new product line |

| 3-6 | Monitor sales and adjust as needed |

9. How can small businesses reduce costs and manage expenses effectively?

Effective Strategies to Reduce Costs

Implementing effective cost reduction strategies is pivotal for the financial health of small businesses. These strategies can range from simple steps like streamlining operations to more complex measures like implementing advanced technology.

- Streamlining Operations: Review your business operations regularly, identifying and eliminating non-essential processes or inefficiencies. This can help cut needless expenses and enhance productivity.

- Remote Work Arrangements: If possible, adopt remote work arrangements. This can significantly reduce overhead costs like office rent, utility bills, and maintenance costs.

- Implementing Technology: Invest in technology to automate routine tasks. This can lead to significant savings in the long term, although it may require an upfront investment.

Managing Expenses Effectively

Managing expenses effectively is another crucial aspect of maintaining the financial health of a small business, which can be done by rigorous budgeting as well as tracking and monitoring expenses.

| Method | Description |

|---|---|

| Budgeting | Create a detailed budget and stick to it. Estimate your income and expenses, assign specific amounts to different expense categories, and make sure that your spending does not exceed your earnings. |

| Tracking Expenses | Keep a strict record of all your expenses. Use bookkeeping software or hire a professional accountant to keep track of where your money is going, allowing you to keep your finances under control. |

Cost Negotiation and Vendor Relationship

Lastly, negotiating costs with vendors or service providers and maintaining good relationships with them can play a significant role in managing finances effectively.

- Negotiating Costs: Reach out to your vendors and negotiate the costs of goods or services. Even a small reduction in costs can lead to significant savings over time.

- Vendor Relationships: Establishing a good relationship with your vendors can lead to better credit terms and lower prices, helping you manage your cash flow more effectively.

10. What role does financial planning play in the growth and success of a small business?

The Importance of Financial Planning in Small Business Growth and Success

Financial planning is often considered the backbone of a successful small business. It plays a vital role in multiple aspects of company growth and prosperity, from setting achievable goals to securing investment funds and managing operating cost.

Here are some key roles of financial planning in small business success:

- Forecasting and Budgeting: It involves predicting future revenues, costs, and returns, which helps align the budget and avoids unnecessary expenses. Not only does this facilitate strategic decision-making, but also promotes financial efficiency.

- Cash Flow Management: Effective planning ensures continuous cash flow, mitigating the risk of insolvency. It helps manage payrolls, supplier payments and other obligations without strife.

- Growth Planning: It helps set realistic targets by analyzing current financial status and market trends. This aids to determine feasible expansion plans or new project developments.

- Risk Management: Anticipating potential financial risks and drafting contingency plans to cope with them is another crucial role of financial planning. This fosters stability and contributes to long-term success.

How Financial Planning Influences Business Performance

Financial planning's impact can be evaluated by considering various financial and operational metrics.

| Metric | Impact of Financial Planning |

|---|---|

| Profit Margins | By controlling costs and optimizing pricing strategies, financial planning can significantly improve profit margins. |

| Operational Efficiencies | Through budget allocation and cost control measurements, businesses can enhance operational efficiencies. |

| Risk Mitigation | By identifying and planning for potential financial risks, businesses can guard against unexpected downturns. |

| Investment Opportunities | Financial plans outlining profit forecasts and growth strategies can attract potential investors, bringing additional funding to help fuel business growth. |

Thus, financial planning is an indispensable part of a small business's strategy helping to steer it towards sustainable growth and success.

Conclusion

Perfect Financial Management in Small Business with Retainr.io

Mastering financial management, particularly in the small business sector, is crucial for business integrity, growth, stability and sustainability. Effective strategies include regular financial evaluation, efficient budgeting, cost control, diversification, and the use of modern technology for financial management.

For small businesses in particular, cash flow management can be quite challenging. That's where technologies like Retainr.io come into play. This innovative software allows small businesses to effortlessly manage clients, orders, and payments with their customized-branded application.

Unleashing the Potential of Technology with Retainr.io

Embracing cutting-edge technologies can streamline financial management and open new avenues for small businesses. One such technology is Retainr.io, a highly-strategic, user-friendly, and resourceful platform specifically designed to comprehensibly handle order and payment management.

Why Choose Retainr.io?

Retainr.io equips your business with a robust mechanism to process orders, manage clients, and handle payments effectively. The white-label software enables businesses to become more independent, reduce redundant tasks, cut costs, and ultimately improve the bottom line.

With Retainr.io, businesses can leverage the power of digital technology to make financial management more time-efficient and accurate. More excitingly, Retainr.io allows businesses to customize their own branded app, amplifying their market presence and establishing a stronger connection with their customer base.

Leverage the power of Retainr.io to enhance your financial management strategies, streamline business operations, and promote growth and profitability in the highly competitive small business world.

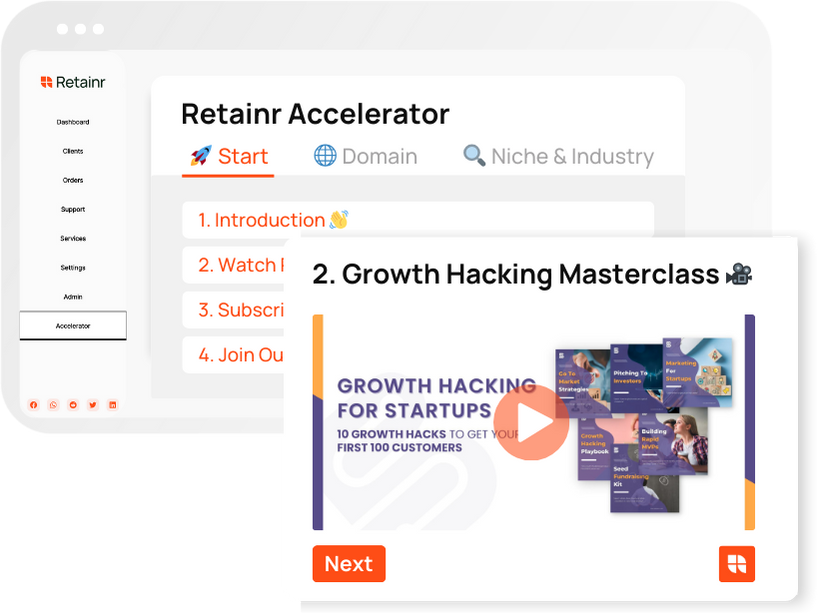

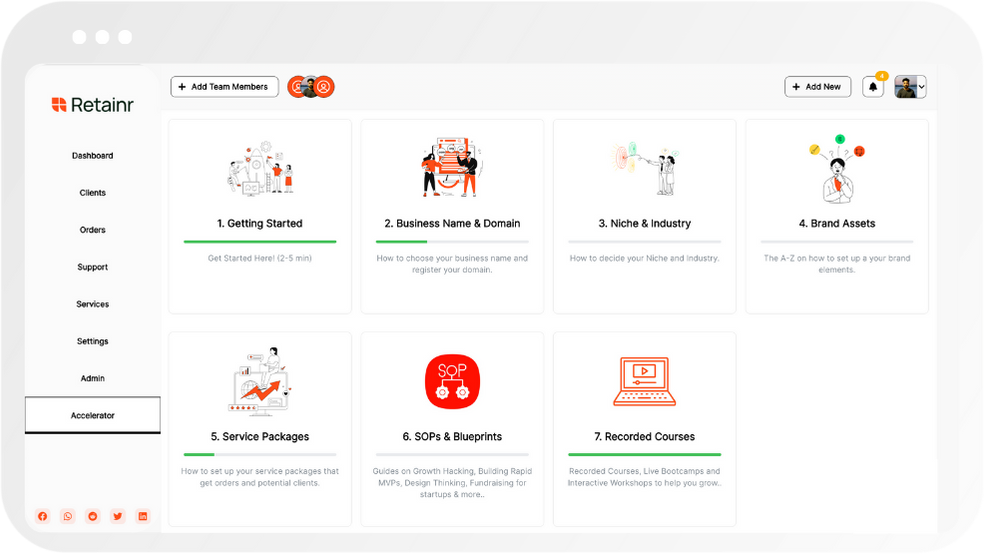

Boost Your Agency Growth

with Retainr Accelerator

Uncover secrets, strategies, and exclusive blueprints to take your agency's growth to the next level — from marketing insights to effective presentations and leveraging technology.

SOPs, Cheatsheets & Blueprints

Leverage 50+ SOPs (valued over $10K) offering practical guides, scripts, tools, hacks, templates, and cheat sheets to fast-track your startup's growth.

Connect with fellow entrepreneurs, share experiences, and get expert insights within our exclusive Facebook community.

.jpg)

Join a thriving community of growth hackers. Network, collaborate, and learn from like-minded entrepreneurs on a lifelong journey to success.

Gain expertise with recorded Courses, Live Bootcamps and interactive Workshops on topics like growth hacking, copywriting, no-code funnel building, performance marketing and more, taught by seasoned coaches & industry experts.

.jpg)

.jpeg)