8 Money Management Tips for Freelancers

Build with Retainr

Sell your products and services, manage clients, orders, payments, automate your client onboarding and management with your own branded web application.

Get Started1. What are some top money management tips for freelancers?

Understanding Freelancer's Financial Management

Freelancing brings with it freedom and flexibility, yet it also requires robust financial management. Freelancers often struggle with unstable income and lack of financial safety nets, such as company-sponsored retirement plans or health insurance. The following are some top money management tips to help freelancers balance expenses and revenue:

- Track Every Expenditure: Maintain a record of every payment and purchase. Documenting these details enables you to understand where your money goes and reveals areas for potential savings.

- Set a Budget: While income fluctuation makes this challenging, it is still critical to have a budget. Setting aside a fixed percentage of your income for essential bills, savings, and taxes helps manage your cash flow efficiently.

- Set Aside Money for Taxes: As a freelancer, you are responsible for your own tax payments. Estimating how much you need to pay in taxes and setting that amount aside is crucial to avoid any unpleasant surprises at tax time.

Prudent Investment and Solid Backup Plans

Securing your financial future is equally, if not more, important. Here are some ways to protect and grow your wealth:

- Start an Emergency Fund: An emergency fund can cover your expenses in periods of low income. It serves as a safety cushion in cases of unexpected events or emergencies.

- Invest in Retirement Savings: Don’t neglect your future needs. Contribute regularly to a retirement account or a self-employed pension plan.

- Get Insured: Health, disability, and life insurance are some types of cover that will protect you from substantial unexpected expenses.

Freelancer's Financial Plan in a Table

Here is a simple view of the financial plan every freelancer should consider:

| Tracking | Budgeting | Taxes | Emergency Fund | Retirement Savings | Insurance |

|---|---|---|---|---|---|

| Keep record of every transaction | Set aside a fixed percentage for essentials | Estimate and set aside tax amounts | Prepare for unexpected events | Plan your future needs | Shield yourself from large unexpected expenses |

2. How can freelancers more effectively manage their finances?

Consistent Budgeting and Financial Planning

One of the most critical money management tips for freelancers is creating and sticking to a budget. By tracking income and expenses, freelancers will have a clearer picture of their financial status. This involves noting down all sources of income and every expense incurred. Here's a basic way to structure a monthly budget:

| Income | Expenses |

|---|---|

| Client 1 | Rent/Mortgage |

| Client 2 | Utilities |

| Other Income | Internet and Phone bills |

| Groceries | |

| Transport |

Fund Allocation

After creating a budget, freelancers must also be vigilant about allocating funds. This involves setting aside money for key financial goals such as retirement, emergencies, and taxes. An easy way to do this is by using the 50/30/20 rule where:

- 50% of income goes to needs (like groceries, rent, and bills)

- 30% goes to wants (like eating out, hobbies, and other luxuries)

- 20% goes to savings (like emergency funds, retirement funds, and taxes)

Use of Financial Management Tools

Last but not least, freelancers can benefit greatly from financial management tools. These apps can help track income and expenses, create and manage budgets, remind them of due bills, and even provide useful financial advice. There are numerous financial management tools available for freelancers, including Mint, QuickBooks, and FreshBooks. When choosing one, freelancers should consider factors like cost, ease of use, and the specific features they need.

3. How can freelancers set a budget for their finances?

Setting a Budget as a Freelancer

Establishing a budget as a freelancer can initially seem challenging given the unpredictable nature of freelance income. Nevertheless, a defined budget can help you manage your finances more efficiently. Here are some steps you can follow:

- Determine your monthly income: As a freelancer, your income may fluctuate from month to month. Consider your lowest earning month as your baseline income to ensure you've reserved enough funds for leaner periods.

- Establish essential costs: This includes things like rent, utilities, health insurance, groceries, and other necessities. These are expenses that have to be paid regardless of your income.

- Allocate for business expenses: These may include supplies, software or hardware purchase, marketing, advertising, professional networking, or any other costs needed to run your business.

- Consider putting aside a part of your income for savings and investments: This can help in the long run for emergency expenses or future financial goals.

An Example of a Freelancer's Monthly Spending Plan

The following table illustrates an example of how a freelancer’s monthly budget might break down. Remember, personal finance is incredibly subjective, so your percentages might look different depending on your circumstances.

| Expense Category | Percentage of Income | Description |

|---|---|---|

| Essential Living Expenses | 50% | Includes housing, utilities, groceries etc. |

| Business Expenses | 20% | Tools, marketing and other business-related expenditures. |

| Savings and Investments | 20% | This percentage goes into an emergency saving fund or towards future financial goals. |

| Leisure and Extras | 10% | Spending related to hobbies, entertainment, or non-essential items. |

Use Budgeting Tools and Apps

Managing finances manually can be time-consuming. Thus, using budgeting tools can simplify the process. There are many budgeting apps like Mint, YNAB (You Need a Budget), and Quickbooks specifically designed for managing personal or business finances. These applications help track your income and expenditure and can automatically categorize your spending into different buckets, making it easier for you to keep a tab on where your money is going. You can also set budget limits to ensure you stay within your planned budget.

4. Is it important for freelancers to constantly track and review their finances?

Tracking and Reviewing Finances as a Freelancer

As a freelancer, it is crucial to constantly track and review your finances. Without a human resources department managing your paychecks or a financial officer to keep tabs on your expenditure, it's all up to you. Remember, in freelancing, you are both the employer and the employee, so you are responsible for every financial decision you make. This is a huge task, but you can make it simpler by regularly updating a personal financial spreadsheet or utilizing a finance management app.

Without regular reviewing and tracking, you risk running into financial pitfalls such as falling behind on income tax payments, running out of money for your business or personal expenses, or even failure to invest strategically and secure your financial future. Here are some of the benefits of constantly tracking and reviewing your finances:

- Anticipating Taxes: Freelancers are often caught off guard by huge tax bills. By tracking your income, you can anticipate your tax obligations and plan ahead.

- Planning for Retirement: Unlike an employed person who has a pension scheme, for a freelancer planning for retirement falls solely in their hands. Constant financial reviewing can help you allocate some of your profits towards a retirement fund.

- Accurate Billing: By tracking your finances, you can record your working hours accurately which ensures correct and fair billing for your clients.

Financial Tracking and Reviewing Tools for Freelancers

There are several tools that freelancers can use to track and review their finances. Choosing the right one depends on your financial needs. Here are some tools and what they can do:

| Tool | Description |

|---|---|

| Quickbooks | An accounting software program that allows you to easily track income and expenses, invoice clients, and prepare for taxes |

| Mint | A personal finance app that gives you a consolidated view of your financial activities, helps you budget, and sends you reminders to pay bills |

| Excel Spreadsheet | Although conventional, it helps to keep a record of your income and expenses and is highly customizable to your liking |

Whichever tool you decide to use, the goal is to be disciplined in updating and reviewing your finances. Tracking your finances should eventually become a habit that is integrated into your daily routine and business operations.

5. What are some tips for freelancers to save for retirement?

Planning for Retirement

Freelancers often face the challenge of saving for retirement due to irregular income. However, with a few tips, they can successfully build a healthy retirement nest. Here are some strategies:

- Set up a Retirement Account: Freelancers should consider setting up individual retirement accounts (IRAs), such as a Traditional IRA or a Roth IRA. These accounts offer tax advantages that can help grow your savings over time. If possible, freelancers could also opt for a solo 401(k) plan, which allows higher contributions.

- Regular Contributions: Consistency plays a key role in building a retirement fund. Make regular contributions, regardless of the amount. This not only builds the habit of saving but also benefits from the power of compound interest over time.

- Invest: Investment can provide a significant boost to your retirement savings. Options such as stocks, bonds, mutual funds, or real estate can help grow your wealth. However, it is essential to consider your risk tolerance, investment goals, and time horizon before investing.

Retirement Savings Plan

Here is a simple retirement savings plan, which includes regular contributions and yearly goals to help freelancers manage their retirement savings effectively:

| Year | Regular Monthly Contribution | Yearly Goal |

|---|---|---|

| 1 | $250 | $3,000 |

| 2 | $300 | $3,600 |

| 3 | $400 | $4,800 |

Utilising Tax Deductions

Freelancers should not overlook the potential tax deductions associated with retirement contributions. Contributions made to IRAs, solo 401(k)s, and certain other retirement accounts can often be deducted from taxable income, thereby reducing your tax liability. These tax savings can then be redirected into your retirement savings. Always consult with a tax advisor or professional to fully comprehend and take advantage of these tax regulations.

6. How can freelancers reduce their tax liability?

Understand and Optimize Your Deductions

One of the effective ways by which freelancers can reduce their tax liability is by understanding and optimizing their deductions. Freelancers are entitled to several tax deductions, including expenses for home office, internet usage, mobile phone usage, and others. It is essential to keep a record of these expenses to qualify for the deductions.

Federal tax Deductions for Freelancers

| Type of Expenses | Possible Tax Deductions |

|---|---|

| Home Office Expenses | Part of your rent, utilities and repairs can be deductible |

| Internet and Mobile Phone Usage | If used for work, a portion can be deducted |

| Travel Expenses | Cost of flights, hotels, meals and incidentals during work travel |

| Professional Development | Costs of courses, books, conferences, professional memberships |

Other Considerations

Alongside tracking and claiming applicable expenses, freelancers can reduce tax liabilities by contributing to solo 401(k) plans or Simplified Employee Pension (SEP) IRAs. Contributions to these retirement plans are tax-deductible, enabling freelancers to decrease their taxable income. Another valuable tax-saving strategy is to make estimated tax payments throughout the year. This not only avoids a large tax bill at year's end but also eliminates potential penalties for underpayment of estimated taxes. Here is a brief list:

- Contribute to solo 401(k) plans or SEP IRAs

- Make estimated tax payments throughout the year

- Consult a tax professional to ensure all potential deductions are considered

7. Why should freelancers separate personal and business expenses?

Importance of Separating Personal and Business Expenses

The practice of separating personal and business expenses can offer numerous advantages for freelancers. Although it might seem simpler to use one account for all transactions, this can lead to financial confusion and make tax preparation significantly more complicated. Here are three main reasons why freelancers should consider separating their personal and business expenses:

- Ensuring accurate bookkeeping: Mixing personal and business expenses can result in messy financial records, making it harder to keep track of your business performance. With separate accounts, you can easily monitor how much you’re earning and spending on your business.

- Simplifying tax preparation: When it’s time to prepare your taxes, untangling personal transactions from your business expenses can be an arduous task. Having separate accounts makes it simple to determine your taxable income, identify business deductions, and avoid any problems with the IRS.

- Protecting personal assets: In some cases, blurring the lines between personal and business finances can put your personal assets at risk. If your business faces a lawsuit or bankruptcy, separate accounts can provide an added layer of protection to your personal assets.

How To Separate Personal and Business Expenses

Although the process of separating personal and business expenses may seem daunting at first, it can be simplified by following certain steps:

- Open a Separate Bank Account: The first step to effectively separating your expenses is to open a standalone business bank account. Use it exclusively for all your business transactions.

- Use Business Credit Cards: Consider applying for a credit card specifically for business use. This will help keep your business spendings separate and can be a good way to build business credit.

- Keep Track of Receipts: Maintain a habit of storing receipts for all your business expenses. This will provide a paper trail that can be instrumental during tax preparation or any financial audits.

On a Final Note

In conclusion, managing finances as a freelancer can be a daunting task, especially without the support of a dedicated financial department. Separating personal and business expenses is a fundamental step towards sound financial management. It not only helps in streamlining your finances but also benefits your tax filings and maintains the financial integrity of your business.

8. Can freelancers leverage technology to manage their finances?

Technology & Freelance Finances

Freelancers can undoubtedly leverage technology to manage their finances more efficiently. There are various software and applications that simplify invoicing, budgeting, tax planning, and income tracking. Utilizing these tools not only reduces the time spent on financial management, but also provides a clear snapshot of your financial status, allowing for more informed decision-making.

The options for such tools include:

- Accounting software: Quickbooks, FreshBooks, and Zoho Books are some invoice and accounting software that record income and expenses, generate invoices, and perform rudimentary analyses of your financial data.

- Expense Trackers: Apps such as Expensify or Mint track and categorize your spending, showing where your money is going and assisting in budgeting.

- Tax Preparation Tools: TurboTax and H&R Block provide end-to-end assistance in preparing and filing your tax returns, minimizing errors and ensuring all potential deductions are flagged.

Choosing the Right Tools

Choosing the right tech depends on your specific needs as a freelancer. When deciding, important factors to consider include the ease of use, integration with other systems, cost, and credibility of the software. Below is a simplified comparison of some common financial management tools with these features in mind:

| Software | Easy to Use | Cost | Reliability |

|---|---|---|---|

| Quickbooks | Very Easy | Reasonable | Highly Reliable |

| FreshBooks | Easy | Affordable | Reliable |

| Expensify | Easy | Free/Affordable | Reliable |

| TurboTax | Moderate | Expensive | Very Reliable |

9. How can freelancers plan their cash flows effectively?

Planning Cash Flows Effectively

Once you’ve determined your average income and expenses, you can begin to plan your cash flow accordingly. Effective cash flow management for freelancers often involves a combination of budgeting, saving, and planning for inevitable lean periods.

- Set a realistic budget: This budget should be based on the average income you expect to earn, ensuring you can cover all your fixed costs and any variable costs you anticipate. In addition, you should always include a margin for possible contingencies.

- Save during the good months: Freelancing work can be unpredictable, and there may be months where you earn more than anticipated. These are good times to save some money for the months where income may be lower than average.

- Plan for lean periods: There will inevitably be months where work is scarce, and your income drops. Your budget should factor in these periods, perhaps by setting aside a monthly amount into a separate 'rainy day' account.

Keeping a regular track of your earnings and expenses will help you adapt your budget to the changing scenario and ensure the health and continuity of your freelance business.

Cash Flow Planning Tool

A helpful tool for managing your cash flow is creating a cash flow statement or chart. This can give you the insight you need to see where your money has been going and to plan for the future effectively.

| Month | Income | Expenses | Net Cash Flow |

|---|---|---|---|

| January | $4000 | $3000 | $1000 |

| February | $5000 | $3200 | $1800 |

From the example above, it is clear that keeping an updated and easy-to-read cash flow chart will keep a freelancer well-informed about their financial health. This way, a freelancer can constantly review and adjust their budget as needed.

10. What is the importance of an emergency fund for freelancers?

Understanding the Importance of an Emergency Fund for Freelancers

Unpredictability often characterizes the freelancing universe. Work demand can fluctuate, clients can abruptly end contracts, and life's unpredicted events can lead to work interruptions. An emergency fund becomes a crucial buffer in such situations. It provides an economic safety net that can support you in times of low client volume or when unforeseen expenses arise.

- Income Stability: In freelancing, income stability is not always guaranteed as it would be in conventional employment. An emergency fund serves as a backup plan during periods of decreased income or no income at all.

- Unexpected Expenses: Freelancers run their businesses, meaning they are responsible for all business-related costs. An emergency fund becomes important when sudden equipment breakdowns or repair costs occur.

- Health Emergencies: Most freelancers do not have the luxury of employer-provided health insurance. Therefore, they should have an emergency fund to cover possible healthcare expenses.

Recommended Levels of Emergency Funds

An emergency fund should ideally be able to cover a freelancer's living expenses for a minimum of three to six months. However, this may vary depending on one's individual circumstances, costs, and risk tolerance. The table shows the recommended levels of emergency funds for freelancers:

| Level | Multiple of Monthly Expenses |

|---|---|

| Minimum | 3 times |

| Average | 6 times |

| High | 9 times or more |

Therefore, the more unpredictable your income or expenses, the higher your emergency fund should be. In conclusion, it is imperative for freelancers to establish and maintain an emergency fund as an insurance against financial uncertainties.

Conclusion

Manage Your Financial Wellness with These 8 Tips

Freelancing brings a unique set of challenges when it comes to money management. With fluctuating income and multiple clients to manage, it can feel overwhelming. Here are eight essential strategies for handling your finances as a freelancer and ensuring your business thrives.

1. Levy a Buffer for Emergency

Unexpected expenses can crop up anytime. Allocate a portion of your income to an emergency fund to cover such situations.

2. Keep Personal and Business Expenses Separate

Create separate accounts for your personal and business expenses to avoid confusion and enable accurate tracking of your finances.

3. Regularly Track Expenses and Income

Consistently monitoring your income and expenses helps you understand your financial situation and enables informed decision-making.

4. Set Clear Payment Terms

Ensure you have clear payment terms with your clients to prevent late or skipped payments. Do not hesitate to follow up on overdue invoices.

5. Understand Your Tax Obligations

Stay updated on tax laws relevant to your field. Consider consulting a tax professional to avoid penalties and make the most of deductions.

6. Save for Retirement

Set aside a portion of your income for retirement. You could consider options like a self-employed 401(k) or an IRA.

7. Insure Your Business

Insurance can protect your business from unforeseen calamities. Find a package that suits your specific needs.

8. Leveraging Technology for Ease

Using the right technology can streamline your financial management. Retainr.io is a white-label software specially developed to assist freelancers in managing clients, orders, and payments effectively. This fully customizable, branded solution lets you manage your business under one platform, helping to save time and effort, and drives better financial management.

By incorporating these tips into your freelance business, you can better manage your finances, reducing stress and setting a strong foundation for business growth.

Boost Your Agency Growth

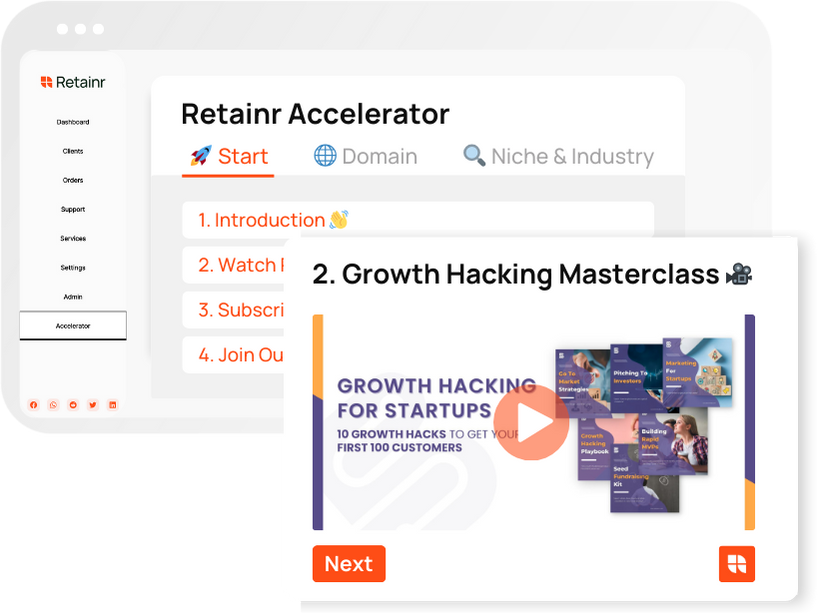

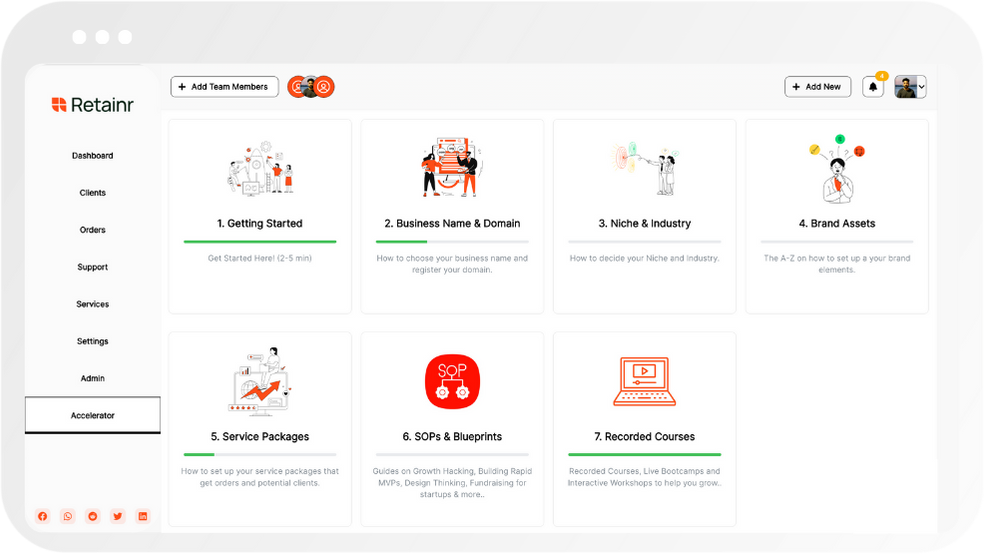

with Retainr Accelerator

Uncover secrets, strategies, and exclusive blueprints to take your agency's growth to the next level — from marketing insights to effective presentations and leveraging technology.

SOPs, Cheatsheets & Blueprints

Leverage 50+ SOPs (valued over $10K) offering practical guides, scripts, tools, hacks, templates, and cheat sheets to fast-track your startup's growth.

Connect with fellow entrepreneurs, share experiences, and get expert insights within our exclusive Facebook community.

.jpg)

Join a thriving community of growth hackers. Network, collaborate, and learn from like-minded entrepreneurs on a lifelong journey to success.

Gain expertise with recorded Courses, Live Bootcamps and interactive Workshops on topics like growth hacking, copywriting, no-code funnel building, performance marketing and more, taught by seasoned coaches & industry experts.

.jpg)

.jpeg)