5 Free Financial Planning Tools for Business Owners

Build with Retainr

Sell your products and services, manage clients, orders, payments, automate your client onboarding and management with your own branded web application.

Get Started1. What are some free financial planning tools for business owners?

Finest Free Financial Planning Tools

Financial planning is a crucial aspect of ensuring the success of any business. Efficient planning not only helps business owners manage their current expenses but also enables them to forecast future financial situations. Given the importance of this aspect, multiple free financial planning tools have emerged that can be an invaluable aid for business owners.

List of Free Financial Planning Tools

- Mint: Mint is a renowned financial planning tool that provides a platform for tracking all your business finances in one place. Its features include budgeting, bill tracking, and getting free credit scores.

- Personal Capital: Personal Capital merges budgeting and investment tracking into a comprehensive financial planning tool. While its wealth management features come with a cost, the financial tracking tool is free.

- GnuCash: GnuCash is an open-source software designed for small businesses. It offers double-entry accounting, following the same process as commercial accounting systems.

- TurboCASH: TurboCASH is accounting software that provides precious financial insights. It supports over 80 different languages and tax accounting standards in 50 countries.

- Wave: Wave offers a suite of financial services and software ideal for small businesses. It includes free personal finance software for managing income, expenses, and invoicing.

Comparison of Tools

| Tool Name | Key Features | Suitable For |

|---|---|---|

| Mint | Budgeting, Bill Tracking, Free Credit Scores | Small to Medium Businesses |

| Personal Capital | Budgeting, Investment Tracking | Medium to Large Businesses |

| GnuCash | Double-Entry Accounting | Small Businesses |

| TurboCASH | Multi-Language Support, Tax Accounting | Small to Large Businesses |

| Wave | Income and Expense Management, Invoicing | Freelancers and Micro Businesses |

2. How reliable are these free financial planning tools for my business?

Reliability of Free Financial Planning Tools

The reliability of free financial planning tools mostly depends on the source providing them. Reputable business management software companies often offer reliable free tools for basic financial planning. These tools are designed to offer an initial insight into your business financial health and encourage you to upgrade to their premium services for more complex financial analysis and projections. Still, even the basic level, they are regularly tested and updated to maintain accuracy.

- Zoho Books: This tool has a free version that allows users to send invoices, sort expenses, track projects, and provide basic reports.

- Wave: This is another free financial software that offers accounting, invoicing, and receipt scanning for small businesses.

- QuickBooks: While this is primarily a paid tool, it has a free trial period during which businesses can leverage its financial planning features.

Free vs Paid Financial Planning Tools

While free financial planning tools can provide a significant amount of valuable data and insights for your business, it's essential to remember that they will have their limitations. Specifically, the scope and depth of the financial analysis available may be limited in comparison to paid versions. Therefore, while they are reliable for basic and intermediate financial planning, for more complex and detailed insights, you might want to consider upgrading or investing in a paid tool.

Limitations and Potential Issues

| Free Financial Tool | Limitations and Potential Issues |

|---|---|

| Zoho Books | Limited to 5 automated workflows, basic reporting, and single currency. |

| Wave | No inventory tracking, no time tracking, and limited reporting. |

| QuickBooks | Limited features available during free trial; full features are unlocked in the paid version. |

3. How can these free financial planning tools help me in budget tracking?

Significance of Free Financial Planning Tools for Budget Tracking

Many business owners often face challenges in tracking their budget, leading to poor financial management and deficit. Free financial planning tools can streamline the process and ensure efficient budget management in several ways. These tools are instrumental in ensuring businesses spend within their financial capacity, helping business owners plan effectively by creating a clearer financial future, and acting as a check to impulsive spending by providing real-time budget balance.

Benefits of Free Financial Planning Tools in Budget Tracking

- Clearer picture of expenses: These tools provide a bird's-eye view of a business's entire spending profile. They show the flow of money, highlighting areas where the business may be overspending.

- Better financial decisions: Having an accurate and up-to-date record of spending details can aid in making informed financial choices, from cutting back on unnecessary expenses to reallocating funds to high-priority areas.

- Enhanced saving culture: By presenting a clear and detailed report of the company's financial progress, these tools can help business owners see the need for savings and make necessary adjustments.

Top Free Financial Planning Tools For Budget Tracking

| Financial Tool | Main Features | Best Suitable For |

|---|---|---|

| Mint | Real-time expense tracking, budgeting, credit check | Small businesses and solopreneurs |

| Personal Capital | Investment planning, budgeting, retirement planning | Established businesses looking for investment opportunities |

| Quicken | Expense management, bill management, loan tracking | Businesses with loans and several bills |

4. Can these free financial planning tools really help me in saving money and increasing profits?

Reliability of Free Financial Planning Tools

One may wonder if free financial planning tools can help in saving money and increasing profits. The answer is a resounding yes. These tools have been designed to help business owners manage finances more effectively, proactively plan for any future expenses and even identify potential areas for additional profit. Below, we'll detail how these tools can help you save money and increase profits.

Improve budgeting: These tools often include budgeting features that enable you to track your income and expenses meticulously. By doing this, you can detect wasteful spending or under-performing assets and redirect these resources to more profitable areas.

Enhance cash flow management: Understand your cash flow patterns better with these financial planning tools. Cash flow management is crucial to maintain liquidity and ensure smooth business operations. Proper management can help save money and avoid unnecessary financial stress.

Strategic financial planning: These tools can help you in setting and tracking financial goals. By watching these digital dashboards you can make timely decisions and adjustments to strategies, potentially leading to increased profits.

Customizing Your Financial Management with Free Tools

The following table illustrates how these tools can help you customize your financial planning process, potentially leading to savings and profit increases.

| Features | Savings Opportunities | Potential Profit Increases |

|---|---|---|

| Budgeting tools | Identify and cut unnecessary expenses | Reallocate resources to profitable ventures |

| Cash flow trackers | Avoid late fees by tracking payments | Ensure liquidity for investment opportunities |

| Strategic planning | Minimize risk with data-driven decisions | Proactively adapt strategies for profitability |

5. How user-friendly are these free financial planning tools for someone who is not tech-savvy?

User Accessibility of Financial Planning Tools

Financial planning tools are designed to be as user-friendly as possible, to facilitate maximum user access. Difficulties emanating from lack of technology knowledge are anticipated, and measures are taken to ensure these tools can be beneficial for all, regardless of their tech-savvy level. Below are some of the features that make these tools user-friendly:

- Straightforward Interface - These tools have a direct and clean interface. They are designed with intuitive layouts and clear labeling to make navigation easier.

- Guided Instructions - When using these tools, users are often provided with step-by-step instructions that guide them through each stage of the financial planning process.

- Help and Support - Most, if not all, of these tools offer resources such as FAQs, tutorials, and customer support to assist users.

Comparative Analysis of User-friendliness

While the free financial planning tools offer various user-friendly features, it is beneficial to compare some of them to understand their usability better. Below is a table that rates the user-friendliness of five such tools on a scale of 1 to 5 (1 being the hardest to use and 5 being the easiest to use).

| Financial Planning Tool | User-friendliness Rating |

|---|---|

| Tool 1 | 4 |

| Tool 2 | 5 |

| Tool 3 | 4 |

| Tool 4 | 3 |

| Tool 5 | 5 |

Concluding Thoughts

Even for business owners who are not tech-savvy, free financial planning tools offer enough hand-holding and user-friendly features to effectively assist in financial planning. All they may require is a basic understanding of how to navigate online platforms. Furthermore, they also provide guides and support systems in case users encounter difficulties along their financial planning journey.

6. What are the benefits of using free financial planning tools compared to paid versions?

Benefits of Free Financial Planning Tools

Free financial planning tools offer several advantages to business owners. An obvious benefit is cost-efficiency. When starting a business, expenses can add up quickly, so using free resources can help save valuable funds. These tools often come with essential features that are suitable for small to medium businesses, making them ideal for starters. Simple to use and understand, these tools reduce the need for extensive training, enabling business owners to concentrate on core business tasks.

- Cost-efficiency: Save on expensive software purchases or subscriptions.

- Essential Features: Offers necessary features suitable for small to medium businesses.

- Usability: Generally simple and straightforward, reducing the need for training.

Comparison with Paid Versions

In comparison to paid versions, free financial planning tools may lack advanced features and dedicated customer support. However, the benefits of saving on expenses, simplicity, and immediate availability often outweigh these shortcomings. In many cases, paid versions provide extensive features that small businesses may not immediately need. With growth and expansion, upgrading to a paid tool becomes an option.

| Factors | Free Tools | Paid Tools |

|---|---|---|

| Cost | Free | Paid |

| Usability | Simple | Complex |

| Features | Basic | Advanced |

| Support | Limited/None | Dedicated |

Finding Balance

Ultimately, choosing between free and paid versions depends on the specific needs and resources of the business. Free tools serve as excellent starting points and continue to be beneficial even as the company grows. It is crucial for business owners to invest time in understanding and using these tools to get the best out of them. Balancing cost and functionality is key in financial planning.

7. How secure are these free financial planning tools in regards to my financial data?

Security of Free Financial Planning Tools

One of the most critical considerations for business owners when using free financial planning tools is the security of their financial data. Each tool usually implements robust security measures to guarantee the confidentiality and integrity of your data. These may include, but are not limited to, secure socket layer (SSL) encryption for data in transit, firewalls, intrusion detection systems, and regular security audits. Despite these measures, always remember that 100% security is never guaranteed; therefore, it's essential always to keep your eyes open.

Critical Security Measures

- Secure Socket Layer (SSL) Encryption: This ensures that all data transferred between your web browser and the servers remain private and integral.

- Firewalls: Firewalls are designed to block unauthorized access to or from a private network. They can be implemented in either hardware or software, or a combination of both.

- Intrusion Detection Systems: These systems act like a burglar alarm for your network, identifying potential threats and alerting you if needed.

- Security Audits: Regular security audits can help identify any potential weaknesses in your system's defenses.

Comparison of Security Measures by Various Free Financial Planning Tools

| Financial Planning Tool | SSL Encryption | Firewalls | Intrusion Detection System | Security Audits |

|---|---|---|---|---|

| Tool 1 | Yes | Yes | Yes | Yes |

| Tool 2 | Yes | Yes | No | Yes |

| Tool 3 | Yes | No | Yes | No |

| Tool 4 | No | No | No | Yes |

| Tool 5 | Yes | Yes | Yes | No |

8. Can these free financial planning tools integrate with the accounting software I currently use?

Integration of Free Financial Planning Tools with Accounting Software

Yes, many free financial planning tools are designed to integrate seamlessly with existing accounting software, making it easier for you to manage your business's finances. This allows you to have a consolidated view of your entire financial picture in one place and provides a comprehensive overview of your business's financial health.

List of Financial Planning Tools and their Integration Capability

- Personal Capital: This tool integrates with QuickBooks, making it easy to keep track of your income, expenses, and investments in one place.

- Mint: Mint offers integration with various accounting software including QuickBooks, FreshBooks, and Xero for a complete financial overview.

- GnuCash: A comprehensive financial tracking application designed to integrate with accounting tools like QuickBooks.

- ANNA: It integrates perfectly with Xero, providing a complete picture of your income and expenses.

- Expensify: Expensify is compatible with a wide array of accounting software, providing quick expense reporting and real-time data sync.

Comparison Table of Different Tools and their Integration Ability

| Financial Planning Tool | Integration Ability |

|---|---|

| Personal Capital | Yes (QuickBooks) |

| Mint | Yes (QuickBooks, FreshBooks, Xero) |

| GnuCash | Yes (QuickBooks) |

| ANNA | Yes (Xero) |

| Expensify | Yes (Multiple Accounting Software) |

9. How can these free financial planning tools assist in my business tax planning?

Understanding Business Tax planning using Free Financial Tools

Business tax planning is an essential aspect of financial management that demands effective strategies. Free financial planning tools can assist you in numerous ways when it comes to organizing and managing your business taxes. Below are specifics ways through which these free tools provide the much-needed help:

- Automating tax calculations: Manual tax calculations can be complex and prone to human error. These tools automate the tax calculation process, ensuring accurate computation of your tax dues.

- Generating tax reports: With these tools, you can generate detailed tax reports, which can help you track and understand your tax obligations better.

- Providing tax advice: Some of the tools provide financial advice based on your income streams and expenses, pointing out tax-saving opportunities you might overlook.

- Ensuring tax compliance: They ensure that your business remains compliant to its tax obligations by keeping tabs on tax deadlines and sending reminders for tax submissions.

Examples of Free Financial Tools for Business Tax Planning

There are a number of free financial planning tools available online which can significantly aid with your business tax planning. Some of these tools are outlined below, along with the tax planning features that they offer:

| Tool | Tax Planning Feature |

|---|---|

| TurboTax Business | Assists with automated tax calculations and provides insights into tax saving opportunities. |

| Mint | Helps track income and expenses, provides reminders for tax submission deadlines. |

| Expensify | Manages receipts and expenses for easy tax deduction calculation. |

| QuickBooks Online | Assists with creating tax reports and ensures tax compliance. |

How to Use Free Financial Tools for Optimal Tax Planning

While having free financial tools at your disposal is one thing, using them for optimal tax planning requires a strategic approach. Here are some tips on how to get the best out of these tools for your business tax planning:

- Data input: Ensure you input accurate financial details into your chosen tool to guarantee correct tax computations.

- Regular use: Make a habit of using the tools frequently to track your income and expenses. This will help optimize your financial activities for better tax planning.

- Updating business changes: Any changes in your business, such as increased revenue sources or additional expenses, should be timely updated in the tool for a more accurate and up-to-date tax planning.

10. Are there any limitations or hidden costs in these free financial planning tools?

Limitations or Hidden Costs in Free Financial Planning Tools

While free financial planning tools can be instrumental for business owners and offer several advantages, it is important to be aware of some limitations or potential hidden costs. Free tools might seem like the perfect solution, but they may lack certain features, have usage restrictions, or entail extra costs for additional services.

Limitations or Usage Restrictions

- Features: While free tools may cover basic features such as budgeting, expense tracking, and financial dashboards, they may not offer more advanced features such as forecasting, project costing, intricate financial modeling, or integration with other software applications.

- Data Limitations: Free tools often limit the number of transactions, accounts, or amount of data that can be managed, which may necessitate an upgrade to a costlier plan for growing businesses.

- Support: Another typical limitation of free financial tools is access to customer support. Many free tools provide limited customer service or require payment for priority support.

Hidden Costs

| Possible Hidden Cost | Description |

|---|---|

| Premium Features | Additional features or functionalities may not be included in the free plan and might require an upgrade to a paid version. |

| Data Security | Free tools may not offer the same level of data encryption, back-up or security measures as their paid counterparts to protect sensitive financial information. |

| Advertising | Free software usually relies on advertising for revenue generation. Thus, using the tool might mean exposure to third-party ads, which may be a distraction or a potential breach of privacy. |

Conclusion

Control Finances with Free Financial Planning Tools

Managing finances is the cornerstone of any successful business. Getting a grasp on your financial situation can mean the difference between business growth and failure. Luckily, several free financial planning tools can help streamline this process for business owners. Here are some of the best:

- Mint: This tool provides a comprehensive view of your business's financial health by tracking expenses, creating budgets, and setting financial goals.

- PocketGuard: A tool perfect for business owners who need help with budget management. It shows you how much money you have left for spending after meeting your business needs.

- Personal Capital: This is best for tracking investments and planning for retirement. The software offers an investment checkup tool and retirement planner to help keep future goals on track.

- Quicken: A robust financial planning tool that helps track expenses, create custom invoices, and manage rental properties, all in one place.

- TurboTax: Ideal for ensuring that your business is getting the most out of your tax returns and that all information is accurate and up-to-date.

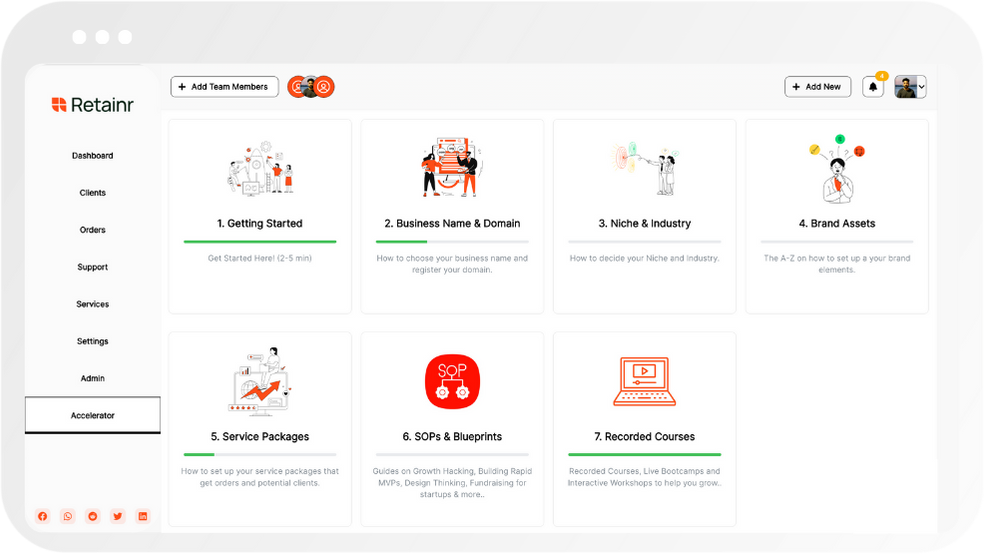

Promote and Sell with Retainr.io

While financial planning tools help you manage your finances, there's another tool to aid in promoting and selling your products and services, managing clients, orders, and payments. That software is Retainr.io.

Retainr.io is a white-label software that provides businesses with a unique app, branded with their logo and accessible by their customers. You can use this to sell your products or services, manage clients, keep track of orders, handle payments, and maintain a professional impression.

Retainr.io offers business owners the chance to provide an enhanced customer experience, with seamless ordering and payment processes and an easy-to-navigate interface. With everything under one roof, business management becomes a breeze.

Whether you're a small-scale business owner or a large enterprise, making your operations and transactions as streamlined and simple as possible is key. So, why not take a step towards business empowerment with Retainr.io? Let Retainr.io become your business' strength and companion, assisting you in the journey towards success.

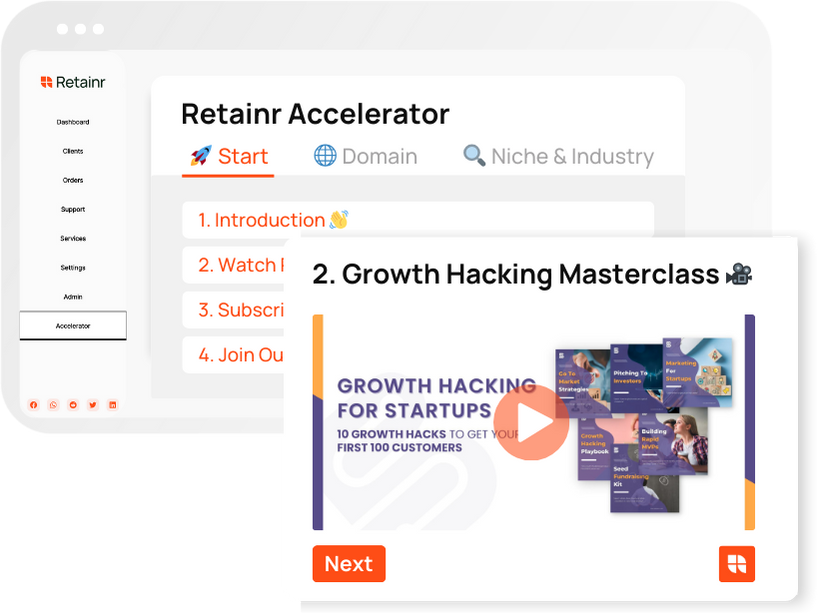

Boost Your Agency Growth

with Retainr Accelerator

Uncover secrets, strategies, and exclusive blueprints to take your agency's growth to the next level — from marketing insights to effective presentations and leveraging technology.

SOPs, Cheatsheets & Blueprints

Leverage 50+ SOPs (valued over $10K) offering practical guides, scripts, tools, hacks, templates, and cheat sheets to fast-track your startup's growth.

Connect with fellow entrepreneurs, share experiences, and get expert insights within our exclusive Facebook community.

.jpg)

Join a thriving community of growth hackers. Network, collaborate, and learn from like-minded entrepreneurs on a lifelong journey to success.

Gain expertise with recorded Courses, Live Bootcamps and interactive Workshops on topics like growth hacking, copywriting, no-code funnel building, performance marketing and more, taught by seasoned coaches & industry experts.

.jpg)

.jpeg)