11 Freelance Accounting Tips To Manage Your Finances

Build with Retainr

Sell your products and services, manage clients, orders, payments, automate your client onboarding and management with your own branded web application.

Get Started1. What are the top 10 freelance accounting tips to manage finances?

Top 10 Freelance Accounting Tips

Freelancing gives you the freedom to be your own boss, but it also means being in charge of your own finances. Here are ten top tips for managing your freelance accounting:

- Track Your Expenses: It's crucial to keep track of every expense related to your business.

- Set Aside Money for Taxes: Always set a portion of your income aside for tax payments.

- Open a Business Account: Separating personal and business finances can help manage your accounting.

- Invoice Promptly: Always invoice clients as soon as work is completed to ensure continuous cash flow.

- Use Accounting Software: Tools like Quickbooks can streamline account management.

- Create a Budget: A comprehensive budget can aid in managing your business.

- Save for Retirement: Setting aside a portion of your earnings for retirement is crucial.

- Consult a Professional: Professional accountants can provide valuable advice and assistance.

- Set Up Automatic Payments: Automating payments can reduce the likelihood of missed due dates.

- Maintain Regular Financial Reviews: Regularly review your financial situation to better understand your business's profitability.

Overview of Freelance Accounting Tips

Managing finances as a freelancer can be complex, but these tips can help streamline the process. Here's an overview of the ten tips:

| Tip | Description |

|---|---|

| Track Your Expenses | Record all business-related expenses for tax deductions |

| Set Aside Money for Taxes | Ensure you have enough to pay your tax bill |

| Open a Business Account | This helps isolate personal and business expenses |

| Invoice Promptly | Promotes regular cash flow by invoicing immediately after job completion |

| Use Accounting Software | Software like Quickbooks can simplify your finances |

| Create a Budget | Plan your spending to avoid unnecessary expenses |

| Save for Retirement | Future-proof your finances by regularly contributing to a retirement fund |

| Consult a Professional | Gain valuable advice about managing your business finances |

| Set Up Automatic Payments | Reduce the risk of payment oversights with automated systems |

| Maintain Regular Financial Reviews | Check your financial status periodically to understand your profitability |

2. How do freelance accounting tips help in managing finances effectively?

Benefits of Freelance Accounting Tips

Freelance accounting tips are practical guides that offer critical assistance in managing finances effectively for independent workers. They help in various ways, as outlined below:

- Budgeting: These tips offer guidance on how to effectively create a budget. By having a clear understanding of your income and expenses, you can plan your finances effectively, avoid overspending, and ensure you have enough savings for future investments or emergencies.

- Tax Planning: As a freelancer, managing taxes can be challenging. Freelance accounting tips help you understand what expenses you can deduct, how to avoid tax penalties, and how to plan your taxes effectively. This results in significant savings and prevents any unwanted legal issues.

- Cash Flow management: For freelancers, income flow can be irregular. Following these tips can help prevent cash flow issues by advising on how to regularly set aside a portion of earnings, invoicing promptly, and chasing overdue payments.

Freelance Accounting Tips Breakdown

The following table provides a more detailed snapshot of some freelance accounting tips and how they can support better financial management.

| Freelance Accounting Tip | Benefit |

|---|---|

| Tracking all income and expenses | Provides full visibility on cash flow, enabling better budgeting and spending decisions. |

| Scheduling regular financial reviews | Helps to identify trends, plan for the future, and find possible areas of concern before they become critical. |

| Implementing a system for chasing unpaid invoices | Minimizes delays in receiving payments, thus improving cash flow. |

Conclusion

Managing finances effectively is crucial for every freelance professional, and these freelance accounting tips are a valuable aid. They can streamline financial processes, ensure legal compliance, and most importantly, enable freelancers to gain control over their financial health. By understanding and implementing these tips, you can focus more on your projects or services and less on financial stress.

3. Are these freelance accounting tips applicable to all freelancers?

Application of Freelance Accounting Tips

Yes, these freelance accounting tips apply to all freelancers, irrespective of their field of work. Whether you are a freelance graphic designer, writer, photographer, or a consultant, managing your finances efficiently is critical to your financial stability and growth. There may be variations in the ways in which different freelancers manage their finances, but the fundamental principles remain the same. Let's take a closer look at the broad applicability of these tips.

The following list shows how these tips can be applicable across various freelance roles:

- Consistent Invoicing: All freelancers deliver services, for which they need to generate invoices. Therefore, it is critical for any freelancer to manage and keep track of their expenses and invoices.

- Accurate Record Keeping: Keeping accurate financial records is not domain-specific, it is a basic necessity for every freelancer to review their financial health and plan their taxes.

- Tax Planning: Every freelancer is subject to tax regulations, and an understanding of one's tax obligations could save money in the long run.

Typical Financial Tasks by Profession

To provide a more specific contextual understanding, let’s explore the common financial tasks and how the freelance accounting tips could be useful in the following professional contexts:

| Profession | Financial Tasks | Freelance Accounting Tips |

|---|---|---|

| Freelance Writer | Managing writing assignments, tracking payments, making invoices | Consistent invoicing, Organizing expenses, Setting financial goals |

| Graphic Designer | Budgeting for software, hardware, managing client payments | Accurate record keeping, Tax planning, setting aside money for expenses |

| Consultant | Tracking billable hours, travel & meeting expenses | Consistent invoicing, Accurate record keeping, Saving for taxes |

4. What are the key benefits of applying these freelance accounting tips?

Understanding the Benefits

Learning to master freelance accounting has several key benefits. Not only does it significantly reduce the likelihood of mistakes and oversights, it also frees up your time so that you can focus on other important aspects of your freelance business. Moreover, it provides a comprehensive and organized overview of your financial status, which is crucial when making any financial decision.

Outlining the Advantages

- Control over Finances: Managing your own finances gives you a clear perspective on your income and expenses. This puts you in a better position to analyze your financial status, plan your budgets, and allocate funds accordingly.

- Greater Accuracy: Mistakes in bookkeeping can have serious implications for a freelancer. Effective accounting reduces any potential inconsistencies or errors, ensuring your finances are accurately tracked.

- Time-Saving: With good accounting practices in place, it's easier to keep your financial records in order, saving you considerable time when preparing your taxes or applying for loans.

- Financial Decision-Making: Understanding your financial position can help you make informed decisions about your freelance business, from investment opportunities to rates negotiation.

The Impact of Effective Freelance Accounting

| Without Freelance Accounting Tips | With Freelance Accounting Tips |

|---|---|

| Difficult to track finances due to disorganization. | Easy, clear insight into financial status. |

| Increased chance of bookkeeping errors. | Reduced mistakes and greater accuracy. |

| Challenging tax preparations and lengthy loan applications. | Quick, streamlined tax process and efficient loan application. |

| Lack of information for decision making. | Insightful, data-driven decision making. |

5. Are there specific accounting software recommended for freelancers?

Recommended Accounting Software for Freelancers

As a freelancer, managing your finances can be a behemoth task, especially if you are juggling multiple clients. This is where accounting software comes into play. They not only simplify your everyday tasks but also help to get an accurate picture of your financial health. Here are some of the recommended accounting software specifically designed for freelancers:

- QuickBooks Self-Employed: A tailor-made software for freelancers that helps to separate personal and business expenses, automatically track mileage, and estimate taxes quarterly.

- FreshBooks: Designed for small business owners, its user-friendly interface makes invoice management, expense tracking, and time tracking a breeze.

- Wave: This is a free financial software for small businesses. It offers comprehensive invoicing, accounting, and receipt scanning services.

- Zoho Books: Ideal for solopreneurs and consultants, it excels at contact and project management, offering excellent customization for invoices and other forms.

- Xero: Xero offers robust accounting with ample reports, integrated payroll, project management, inventory tracking, and multiple currency support.

| Software | Key Features |

|---|---|

| QuickBooks Self-Employed | Expense Separation, Mileage Tracking, Tax Estimation |

| FreshBooks | Easy Invoicing, Time & Expense Tracking |

| Wave | Free Financial Software, Receipt Scanning |

| Zoho Books | Contact & Project Management, Invoice Customization |

| Xero | Robust Accounting, Multiple Currency Support |

Remember, the best accounting software for your freelance business will depend on your specific needs. If you require a simple solution to track income and expenses, then Wave might suit your needs. If you deal with international clients and need advanced features like multiple currency support, Xero would be a great fit. Consider your business requirements and choose the software accordingly.

6. How can these accounting tips help freelancers in reducing their tax liabilities?

Reduction of Tax Liabilities

With the proper accounting strategies in place, you can considerably reduce your tax liabilities as a freelancer. Below are some ways these accounting tips can be helpful:

- Track and Deduct Business Expenses: By keeping track of all business-related expenses, freelancers can claim these as deductions. This reduces the amount of their taxable income, therefore reducing their overall tax liability. This could refer to anything from office supplies to travel costs or professional development courses.

- Claim Home Office Deductions: Freelancers often work from a home office. It's important to square away the portion of your home used specifically for your business, this attracts a deduction that can reduce your taxes.

- Incorporation: In some cases, converting to a Limited Liability Company (LLC) or an S-Corporation can provide freelancers with tax advantages, including reductions in self-employment taxes.

| Deduction | Description |

|---|---|

| Business Expenses | Any cost incurred in the ordinary course of business can be deducted, such as office supplies, travel, and professional development courses. |

| Home Office | Claiming a deduction for the portion of your home used specifically for business purposes can considerably reduce your taxes. |

| Incorporation | Transforming into an LLC or S-Corporation can lower your self-employment taxes. |

Each freelancer's situation is unique, hence it's recommended to engage a tax advisor or an accountant to offer personalized advice. By following these accounting tips, freelancers can properly manage their finances, understand their earnings, and even reduce their tax liabilities.

7. Can these accounting tips help freelancers in saving more money?

Yes, Freelance Accounting Tips Can Help Save More Money

Indeed, adhering to certain freelance accounting tips can facilitate better management of finances, inevitably leading to significant savings. Proper tracking of income and expenses, setting aside money for tax payments, and adopting a habit of reviewing finances regularly are just some ways that freelancers can save more money.

- Tracking revenue and costs: By diligently recording all revenues and expenses, freelancers will have a clear picture of their financial situation, enabling them to identify areas where expenses can be reduced. In addition, they can avoid late fees by knowing exactly what invoices are due and when.

- Tax planning: Freelancers who set aside money for taxes with each payment received can avoid the burden of large tax bills at the end of the year. They can also take advantage of tax deductions specific to freelancers to reduce their overall tax liability.

- Regular financial reviews: Frequent and thorough reviews of financials can help freelancers identify income patterns or expenditure trends. This understanding can be crucial for making informed decisions about raising rates, reducing expenses, or investing in new business ventures.

Examples of Potential Savings

To illustrate the potential financial benefits of following these accounting tips, consider the following example of a freelance graphic designer's monthly finances:

| Item | Without Accounting Practices | With Accounting Practices | Potential Savings |

|---|---|---|---|

| Invoices Paid | $5000 | $5000 | - |

| Business Expenses | $2000 | $1500 | $500 |

| Late Fees | $150 | $0 | $150 |

| Tax Payment | $1500 (annual) | $1250 (annual) | $250 |

This example clearly demonstrates that by adopting just a few simple accounting practices, freelancers can potentially save hundreds of dollars each month, improving their overall financial stability.

8. Are there any resources or guides available to learn more about these freelance accounting tips?

Useful Resources to Learn Freelance Accounting

There are a plethora of resources available to grasp a better understanding of freelance accounting. Some of the most useful ones include:

- Books: Books like 'The Accounting Game: Basic Accounting Fresh from the Lemonade Stand' by Judith Orloff and Darrell Mullis or 'Accounting Made Simple' by Mike Piper offers simple and easy to understand insights into the world of accounting.

- Online Courses: Websites like Coursera, Udacity, and Khan Academy offer free and paid online courses where you can learn accounting at your own pace.

- Websites: Websites like AccountingCoach, Investopedia or The Balance offer a wealth of information on different aspects of accounting.

- Software: Accounting software like Quickbooks, Zoho Books, or Xero are designed to simplify the accounting process and often come with tutorials and guides to help you get started.

Guides to Freelance Accounting

If you prefer a more structured approach, there are step-by-step guides available that can help demystify freelance accounting. Some of the most popular include:

| Title | Author | Where to Find |

|---|---|---|

| The Simplified Guide to Not-for-Profit Accounting, Formation & Reporting | Laurence Scot | Amazon |

| Accounting for the Numberphobic: A Survival Guide for Small Business Owners | Dawn Fotopulos | Amazon |

| Small Business Financial Management Kit For Dummies | John A. Tracy | Amazon |

Freelance Accounting Blogs and Forums

Finally, staying updated with the latest trends and discussions in the world of freelance accounting can be a good way to continuously enhance your skills.

- Blogs: Blogs like 'The Accountex Report', 'Accounting Today', and 'CPA Trendlines' provide news, tips, and insights into the accounting world.

- Forums: Forums like 'AccountingWEB', 'AAT Discussion forums', or 'The Tax Book Forum' can be a good place to discuss your queries or concerns related to freelance accounting.

9. How often should a freelancer reassess their finances using these accounting tips?

Frequency of Financial Reassessment for Freelancers

Regular financial reassessment is crucial for anyone, more so for freelancers whose income might fluctuate more significantly. Depending on a few factors such as the complexity of your finances, the stability of your income, and your proficiency in accounting, the timeline for financial reassessment may vary.

Time Intervals for Financial Reassessment

- Monthly: For beginners or if your freelance income represents a major share of your total income, you should probably check your finances monthly. This frequency helps you to keep track of your spending, income and taxes. It additionally helps to ensure that no invoice is left unpaid and can curb unnecessary expenses.

- Quarterly: Once you become familiar with managing your finances, you can shift to a quarterly review. Setting aside time every three months to analyze your financial status and future plan gives you a broader perspective and helps identify trends in your earnings or spending.

- Yearly: At a minimum, freelancers should reassess their finances annually. This kind of review is ideal for checking your overall financial progress, estimating your taxes, and setting new financial goals.

Periodical Reassessment Table

| Period | Description |

|---|---|

| Monthly | Helps keep accurate track of income, expenses, and invoices. Ideal for freelancers with unpredictable income patterns or beginners. |

| Quarterly | Allows for broader financial perspectives and helps spot trends in earnings or spending. Suitable for more experienced freelancers. |

| Yearly | Ideal for overall progress check, tax estimation, and financial planning. Minimum recommendation for all freelancers. |

10. What are the best strategies to ensure accurate financial records as a freelancer?

Strategies for Accurate Financial Records

Maintaining accurate financial records requires strategic planning and proper execution. As a freelancer, reliable financial records are vital for taxes, understanding your earnings, tracking expenditures, and mapping your financial growth. Therefore, it's essential to leverage a few strategies.

- Use a Dedicated Business Account: Always separate your personal transactions from your business transactions. By using a dedicated business account, you can prevent any confusing mingling of personal and business finances and ensure accuracy.

- Implement a Robust Accounting Software: Make use of up-to-date and reliable accounting software. This will enable an easier way to track and analyze your financial transactions accurately, without any manual miscalculations.

- Consistent Record Keeping: Be consistent with the way you record your transactions. Make it a daily or at least a weekly task. Consistent record-keeping reduces the risk of forgotten or lost transactions, enhancing accuracy.

- Regular Reconciliation: Consider periodically balancing your accounts and cross-checking them with your bank statements to ensure accuracy.

- Professional Help: A professional bookkeeper or accountant can assist you in ensuring your financial records are accurate. They can help you understand complex financial processes and provide advice on any confusing aspects.

| Strategy | Description |

|---|---|

| Dedicated Business Account | Separate personal from business transactions. |

| Accounting Software | Use software to prevent miscalculations. |

| Consistent Record Keeping | Record transactions regularly. |

| Regular Reconciliation | Balance accounts with bank statements. |

| Professional Help | Use professionals for complex transactions. |

Conclusion

Effective Freelance Accounting Tips

Freelance work gives you the freedom to manage your own time and choose your own projects, but it also requires you to keep track of your own finances. Check out these 11 tips to help you manage your financial affairs more effectively.

- Keep your business transactions separate from personal ones.

- Stay organised and clean up your bookkeeping.

- Stay diligent about tracking expenses.

- Choose the correct bookkeeping software.

- Make use of digital invoicing.

- Always track your time accurately.

- Make a habit of saving for taxes.

- Don’t neglect to send your invoices promptly.

- Stay on top of your payments.

- Consider hiring a professional when needed.

- Automate your processes for simplicity and convenience.

Managing your finances accurately and effectively as a freelancer supports your business operations and contributes towards your overall success.

Streamline Your Freelance Accounting with Retainr.io

To make the process of managing your finances even easier, you should consider using a reliable software like Retainr.io. This whitelabel software is ideal for freelancers as it allows you to sell, manage clients, orders, and payments through your own branded app.

With Retainr.io, you can track your time, issue invoices, and manage your finances in one place, providing a simplified and efficient approach to freelance accounting. Make the smart choice for your freelance enterprise by trying out Retainr.io today.

Boost Your Agency Growth

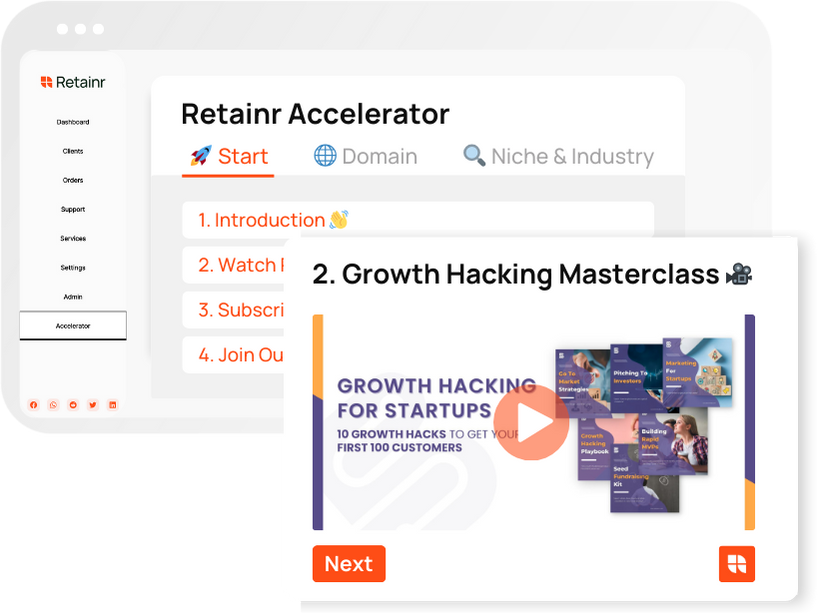

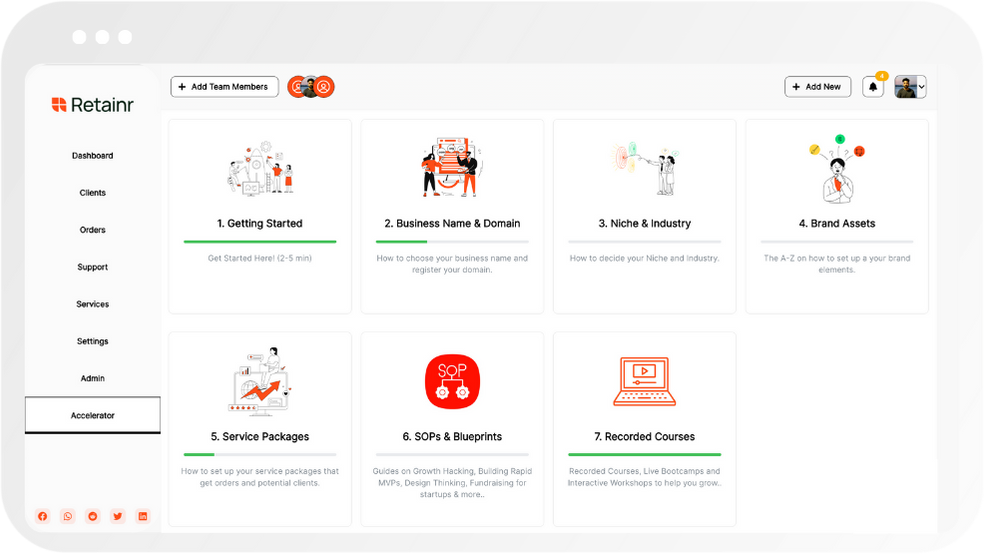

with Retainr Accelerator

Uncover secrets, strategies, and exclusive blueprints to take your agency's growth to the next level — from marketing insights to effective presentations and leveraging technology.

SOPs, Cheatsheets & Blueprints

Leverage 50+ SOPs (valued over $10K) offering practical guides, scripts, tools, hacks, templates, and cheat sheets to fast-track your startup's growth.

Connect with fellow entrepreneurs, share experiences, and get expert insights within our exclusive Facebook community.

.jpg)

Join a thriving community of growth hackers. Network, collaborate, and learn from like-minded entrepreneurs on a lifelong journey to success.

Gain expertise with recorded Courses, Live Bootcamps and interactive Workshops on topics like growth hacking, copywriting, no-code funnel building, performance marketing and more, taught by seasoned coaches & industry experts.

.jpg)

.jpeg)